Is Blue Cross Blue Shield Indirect or Direct Distributiom

Prepared for the Blue Cross Blue Shield Association by Dan White, Dante DeAntonio, Bridget Ryan and Matt Colyar - June 1, 2021

Key Findings

The share of American adults providing uncompensated care to friends or family members with serious medical conditions and the elderly is growing rapidly. It can be extremely difficult to get a good handle on who and where these caregivers are, making it even more difficult to answer key questions about the impact of caregiving on important facets of daily life, especially the economy.

Data collected by the Blue Cross Blue Shield Association is uniquely situated to answer questions about individuals who are likely providing care among the commercially insured population. Detailed dependent care relationships that can be gleaned from this data, at a granular geographic level, add a new dimension to existing studies about who and where these caregivers are and the distribution and impact of caregiving demand across the country.

A more comprehensive understanding of caregiving allows for better estimates of the impact these caregiving arrangements are having on the overall health of the U.S. economy. Within the context of the ongoing COVID-19 pandemic, this understanding becomes even more necessary as the healthcare system is forced to reevaluate how it provides care to the most vulnerable among us. The elevated rate of COVID-related deaths in long-term care facilities has exposed inadequacies in our current system and will re-focus attention on in-home care. Facing waning demand and increased regulatory standards, 30% of long-term care facilities could face bankruptcy in the coming years forcing even more of the caregiving impact in-home and onto unpaid family and friends1.

By using Blue Cross® Blue Shield® data on the total demand for caregiving and the health impact that caregivers face, we can estimate the economic impact of caregiving in more definitive and granular terms relative to previous studies. In our examination of the economic impact of caregiving we have found several interesting and concerning findings, particularly regarding the size and scope of the impact on economic activity.

- The need for caregiving among those with serious medical conditions and the elderly encompasses nearly 51 million Americans. This represents a significant share of the population and much of this demand is satisfied through uncompensated care2. The economic impact of this need can be defined through two main channels. First, the direct economic impact accounting for time spent caregiving and its influence on caregiver decisions around work, absenteeism, and productivity. Second, the indirect economic impact from poor health outcomes among caregivers associated with the demands of providing care.

- The indirect effect that deteriorating caregiver health has on economic outcomes is the most substantial of the two impacts. The Blue Cross Blue Shield Health Index is uniquely positioned to assess the health impact of caregiving. Past studies show that poorer health outcomes are highly correlated with weaker economic outcomes3. The estimated indirect economic effect totals nearly $221 billion.

- The direct economic effect from the need for caregiving is estimated at nearly $44 billion through the loss of more than 650,000 jobs and nearly 800,000 caregivers suffering from absenteeism issues at work. Much of this direct impact is concentrated among those providing care for the most serious conditions who spend a significant amount of time per day in their caregiving role. The overall economic impact of caregiving across the direct and indirect channels is estimated at $264 billion.

Caregiving Demand

In previous research, the Blue Cross Blue Shield Association assessed member-level data to identify patients who need caregiver support4. This identification forms the basis for the county-level caregiving demand estimates used in this report. In order to expand beyond the BCBS member pool to the full commercially insured population under the age of 65 we use data from the American Community Survey to re-scale the preliminary demand estimates. In the 780 counties where ACS data on the commercially insured population is available, we calculate a simple multiplier to scale from BCBS members to the total population. In the remaining counties, we use a state-level multiplier derived by looking at the unaccounted-for remainder of the commercially insured population relative to the BCBS member counts in those counties.

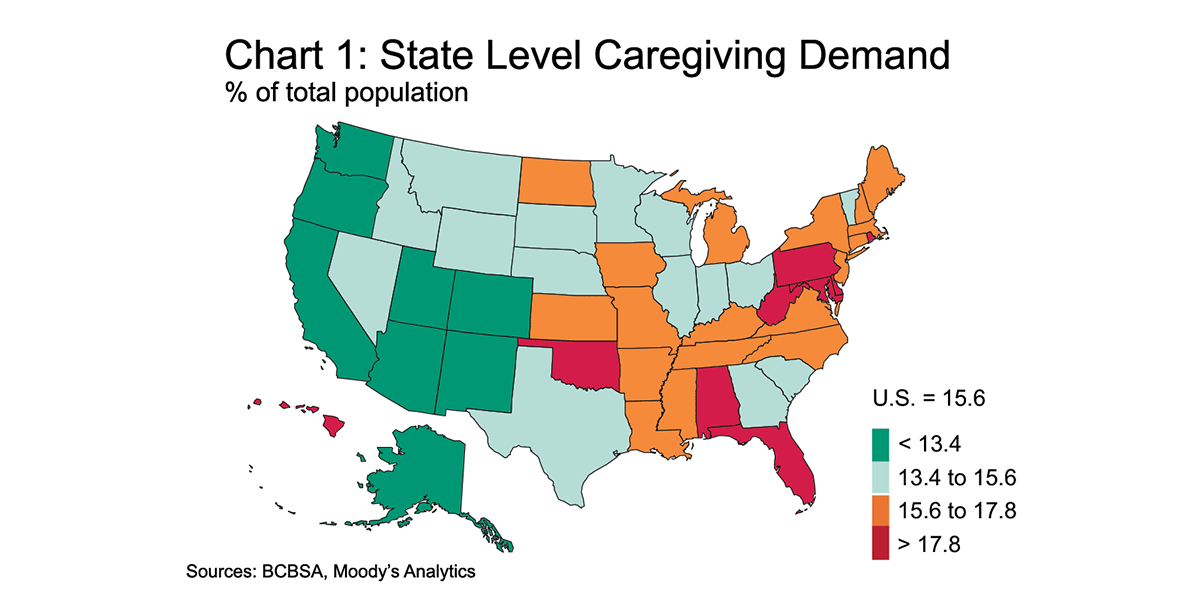

Data on the commercially insured population is supplemented with information on the Medicare Fee-for-Service population to capture caregiving demand among those 65 and older5. The result of this analysis is an estimate that nearly 51 million Americans are in need of some form of caregiving. There is wide geographic variation in this population, however, ranging from 11.1% to 20.7% of total population at the state level (see Chart 1).

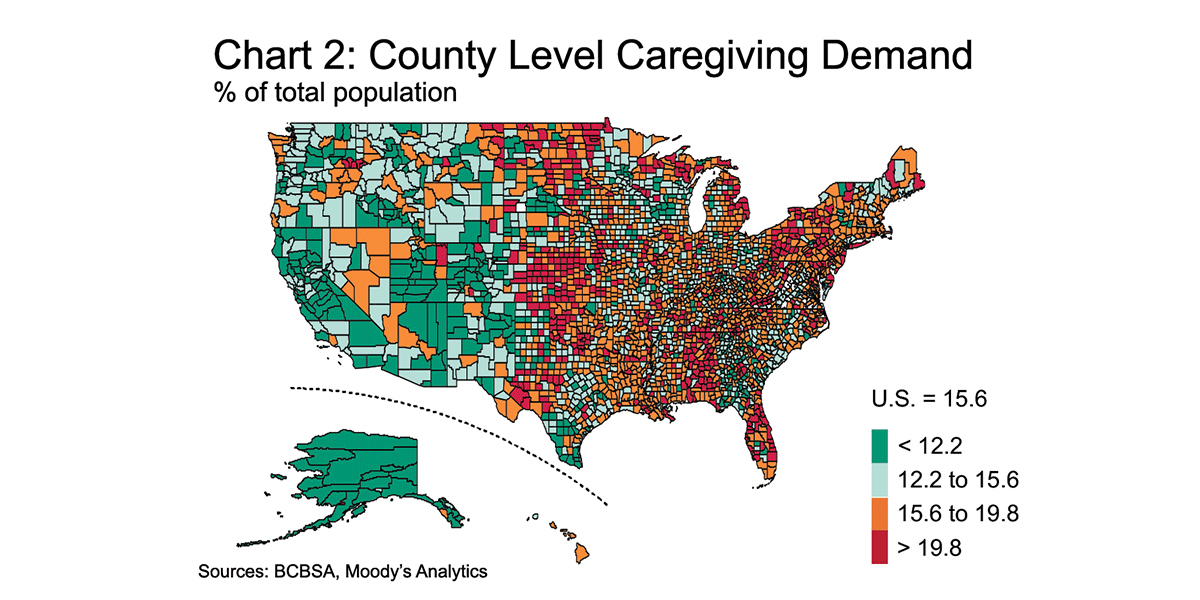

This is driven by several factors, including differing demographic and health profiles. The West region is younger and healthier, on average, which is reflected in the caregiving demand analysis. Viewing caregiving demand only at the state level masks a good deal of variability that occurs at the county level (see Chart 2). At this more granular geographic level, caregiving demand as a share of population ranges from 0.4% to 51.0%.

In addition to identifying total caregiving demand, the BCBS Health Index also provides a window into the health status of those needing care. In order to differentiate the economic impact created by caregiving we segment caregiving recipients into low, moderate, and high demand groups based on a combination of health status and the estimated amount of time spent providing care.

The American Time Use Survey (ATUS) provides detailed information on the time that people spend doing various activities6. To evaluate the distribution of time spent caregiving, two main categories of time use are evaluated: 'caring for household (or non-household) adults' and 'helping household (or non-household) adults.'

The distribution of time spent caregiving is highly right skewed with a large majority of those participating in caregiving activities spending 30 minutes or less per day doing so. The distribution of time spent is used to inform a decision regarding how many caregivers should be put into the low, moderate, and high demand groups. The low demand group consists of the 50% of caregivers who spend 30 minutes or less per day providing care, the mid-demand group represents the 30% of caregivers which spend between 30-105 minutes per day providing care, and the remaining 20% which spend between 105-300 minutes per day round out the high demand group7,8.

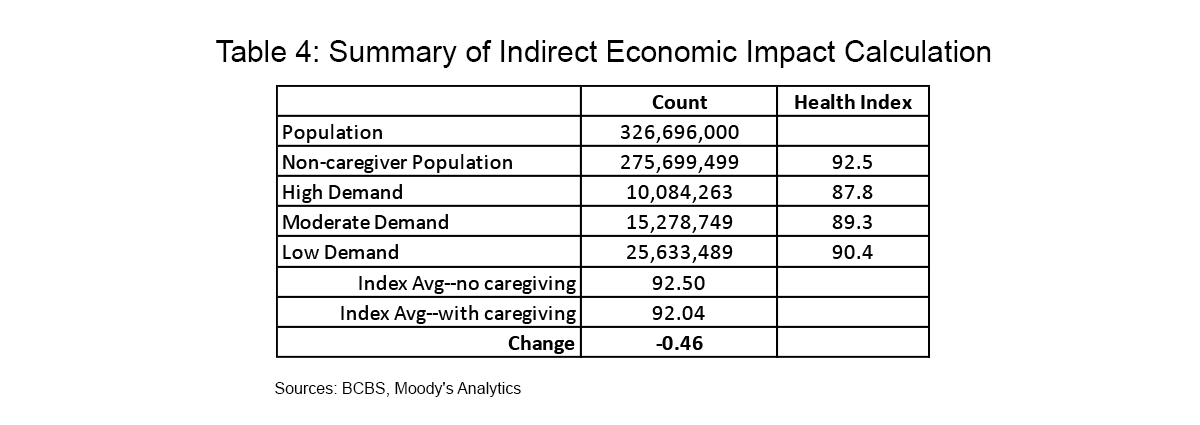

The distribution of caregiving demand groups defined using ATUS data is paired with BCBS Health Index data on caregivers in order to evaluate the impact on caregiver health. BCBSA's previous research showed the impact that providing care has on a caregiver's health9. By segmenting identified caregivers into the 50%/30%/20% distribution defined using the ATUS data, the average BCBS Health Index can be estimated for the different caregiving demand groups. As an example, the benchmark, non-caregiving population has an average index score of 92.5, while the 20% of caregivers in the high-demand group—those with the lowest health index scores—average just 87.8.

In deriving the total need for caregiving, identifying the distribution of caregiving demand, and assessing the health index of caregiving, the foundation has been laid to conduct an analysis estimating the economic impact that caregiving imposes. This impact can be calculated as a dollar-cost estimate of the total income lost as a result of caregiving.

Employment, Absenteeism, and Productivity

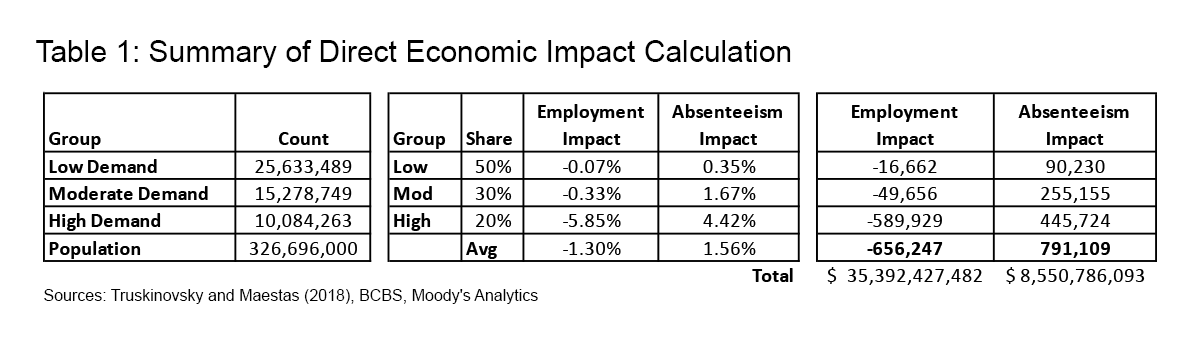

The economic impact of caregiving can be defined through two main channels, direct and indirect. The direct economic impact accounts for the influence caregiving has on decisions around work, absenteeism, and productivity. The direct economic effect resulting from caregiving is estimated at nearly $44 billion through the loss of 656,000 jobs and an additional 791,000 caregivers suffering from absenteeism issues at work (see Table 1).

Much of the existing research on the impact of caregiving on employment outcomes relies primarily on panel data with large time gaps between observations. This makes it impossible to capture the direct employment outcomes in the months before and after caregiving starts. However, Truskinovsky and Maestas provide new evidence of the short-term impacts of caregiving, using ATUS data from 2011 to 201610. In their study time use data is linked to the Current Population Survey to create a panel of caregivers with observed employment outcomes. Caregiving is associated with a 1.3% decrease in the likelihood of working, and a 40% increase in workplace absences in the months after a caregiving spell begins.

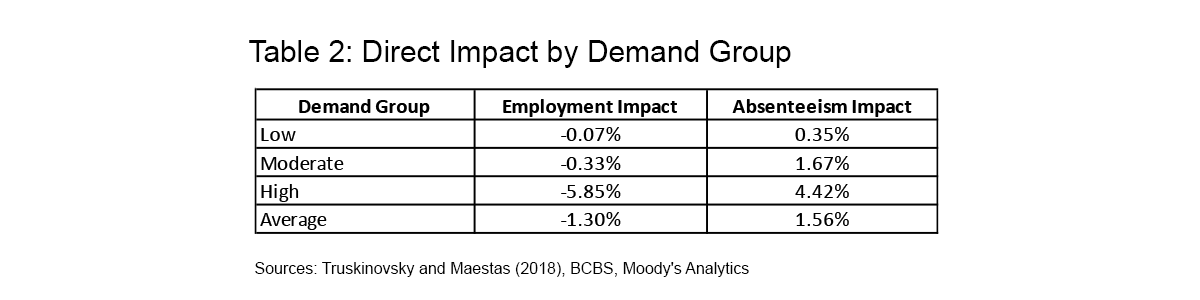

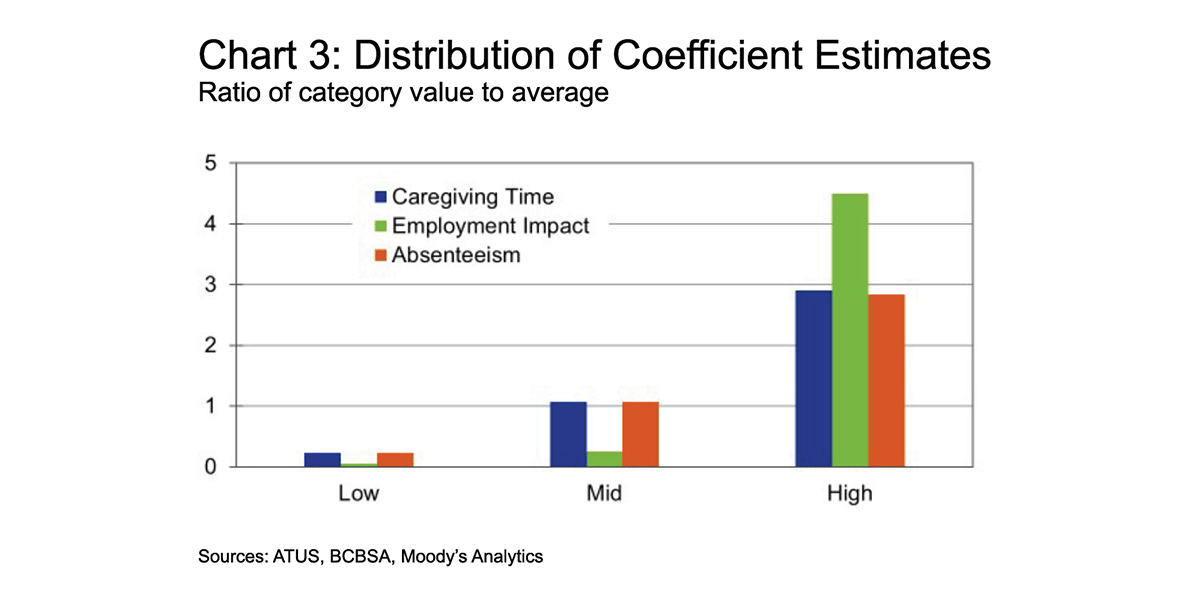

In order to assess these labor market impacts within the parameters of this study using the previously defined caregiving demand groups, the average effects are shared out to the low, moderate, and high demand groups (see Table 2).

The relative distribution of time spent providing care is used as a guideline for this process (see Chart 3). For example, the ratio of the absenteeism impact between the high and low demand groups is set to be consistent with the same ratio in terms of average time spent providing care from the ATUS data. In terms of the employment impact, the effects are set to skew more heavily toward the high demand group as logic would suggest that those spending significantly more time providing care are much more likely to have stopped working as a result.

The decline in income resulting from lost jobs is estimated using average per capita income at the county level. Much of this direct impact stems from the high demand caregiving group in which those providing care spend a significant amount of time per day in their caregiving role.

For those suffering from absenteeism, income losses are assumed to be 20% of average per capita income11. Giovannetti et al (2009) show that across the entire employed caregiver sample, there was a 4.9% loss in work time due to caregiving-related absenteeism. The impact is concentrated among a relatively small share of caregivers with 75% reporting no missed work time, and the results confirm that measures of productivity loss were highly associated with caregiving intensity. Across the entire sample, the productivity loss while at work was 18.5%. The combination of missing work time and being less productive while at work resulted in a total impact of 20.1% productivity loss due to caregiving.

Community Health: Less Healthy, Less Wealthy

The second factor contributing to the economic impact of caregiving is the indirect consequence of poorer health on those providing care. The BCBSA's previous research has demonstrated that the role of continuous uncompensated caregiving carries significant health impacts12. Caregivers were identified among BCBS members who have a spouse or child needing caregiver support. Exclusion criteria are used to eliminate people from the potential pool of caregivers who have medical conditions which would severely reduce the ability to care for others. Among family members meeting the health criteria, the sample of caregivers includes primary subscribers and their spouses caring for children, primary subscribers caring for a spouse, and dependent spouses caring for primary subscribers. Compared to a benchmark population, caregivers were found to have worse health outcomes by 26% as measured by the BCBS Health Index.

Past research around the Health Index also shows that an important consequence of a less healthy resident population is poorer economic outcomes. An economy is traditionally measured by how much it can produce, via its gross domestic product. At its core, GDP is made up of two primary components, the number of individuals producing, and the amount that each individual can produce. Both components are threatened by lower levels of health in the workforce.

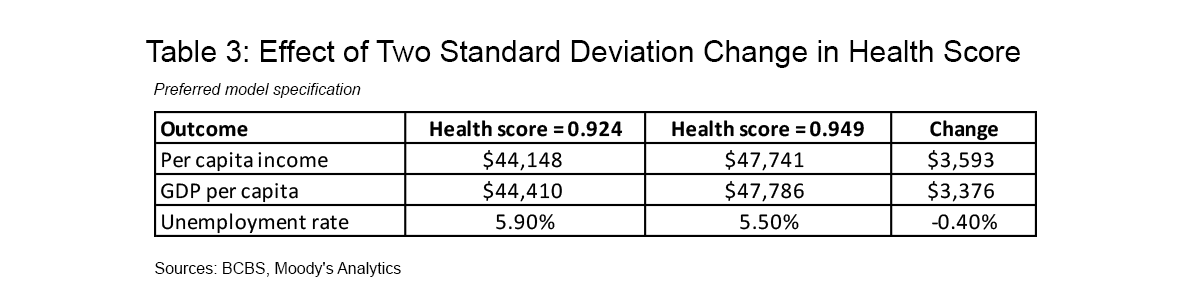

As part of our previous research with the BCBSA, we established that workers who are less healthy also tend to be much less productive, generating lower per-capita incomes and being employed less often13. In addition to the direct impact of the time spent providing care, as caregivers become less healthy, they are more likely to miss work or stop working altogether. Furthermore, even when they are working, health concerns may prevent them from being as productive as they would have been had they had the same health profile as non-caregivers. This research found that variations in health outcomes were strongly correlated with different economic outcomes (see Table 3).

Like the direct economic impact, the focus of this analysis is on the changes in income that result from declining caregiver health. Using data on the BCBS Health Index impact of caregiving in conjunction with estimates of caregiving demand we estimate the change in county-level aggregate health as a result of provider care. This impact on health outcomes, along with the previous study's recommended findings, which controlled for demographic factors and state-by-state variations in healthcare delivery, we can estimate the impact of worsening health status amongst caregivers on county-level per-capita incomes.

We do this by calculating the difference in average county BCBS Health Index values given actual caregiving demand relative to a hypothetical county without any demand for caregiving (see Table 4).

The reduction in health index score is then converted to a z-score change so that the appropriate regression coefficients from our previous research can be applied. This provides an estimate of the corresponding change in the z-score of the logarithm of per capita income, which is then converted to an overall income impact. As a result, the estimated indirect economic effect totals nearly $221 billion, bringing the overall economic impact of caregiving to $264 billion.

Overall Economic Impact and Implications

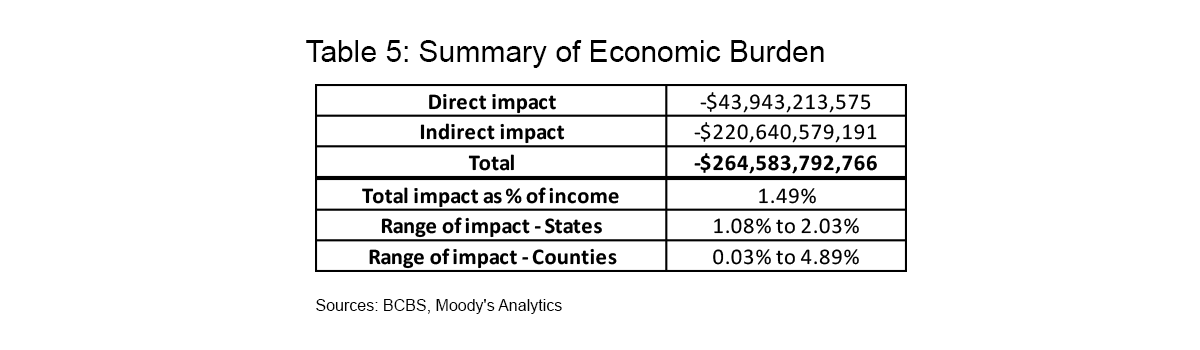

Combining the direct and indirect impacts of caregiving in the U.S. we come to a total economic impact of $264 billion, or roughly 1.5% of national annual income (see Table 5).

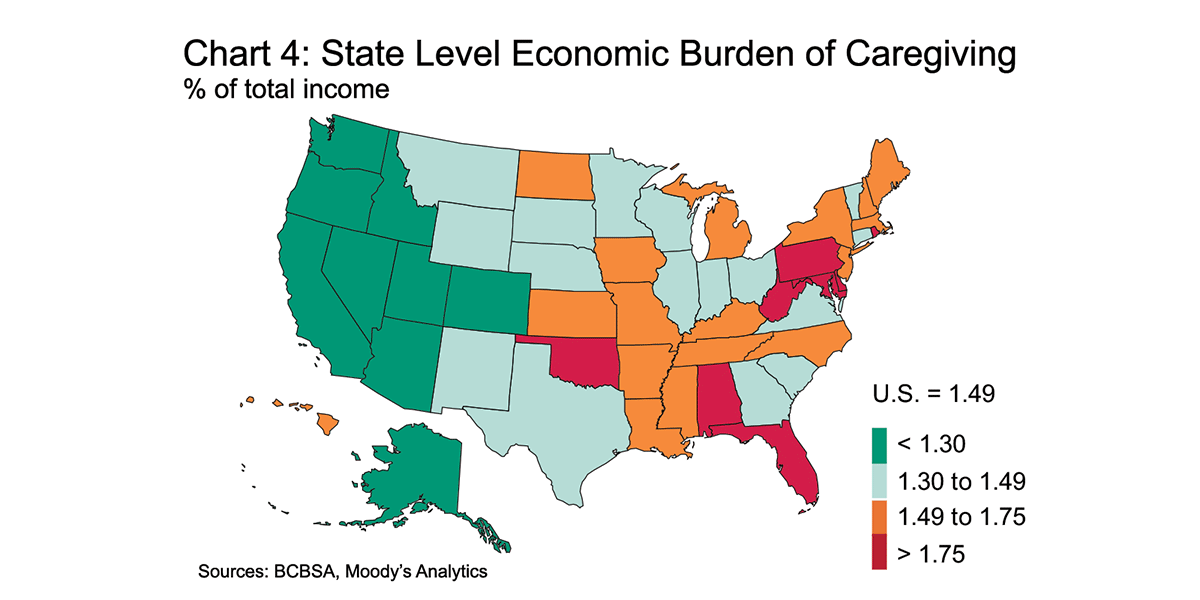

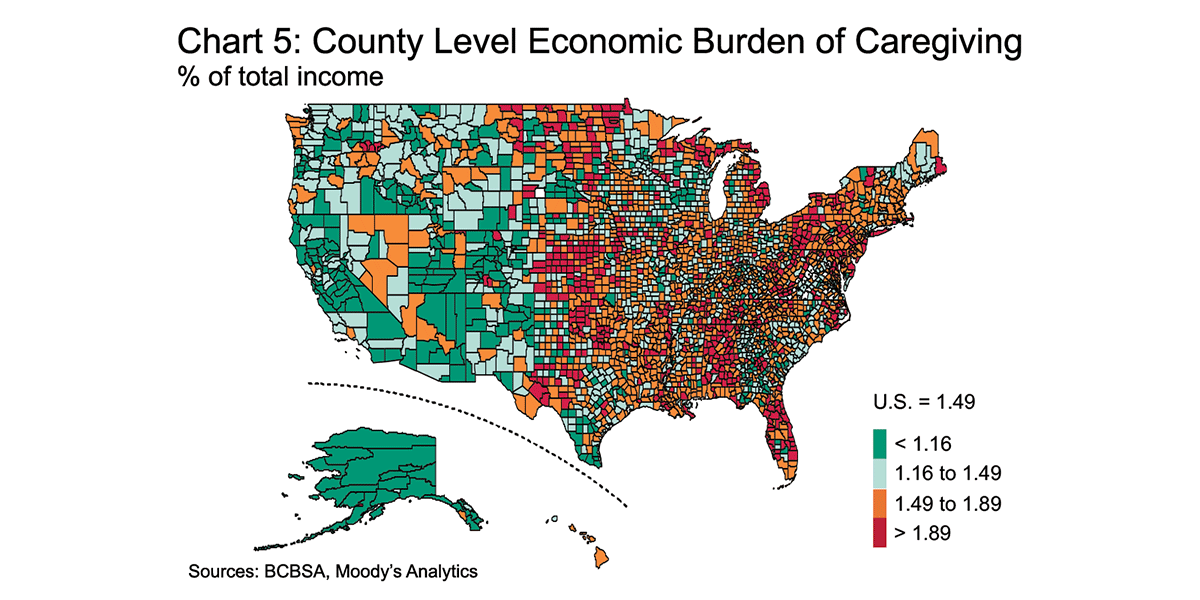

This impact varies substantially across geographies driven by the local need for caregiving (see Charts 4 and 5). Rhode Island, Delaware, Alabama, and Florida top the list of states with the largest impacts as a percentage of income, each with losses equivalent to 1.9% or more of total income. Alaska, Colorado, California, and Arizona face the smallest impacts as a share of income at less than 1.2%.

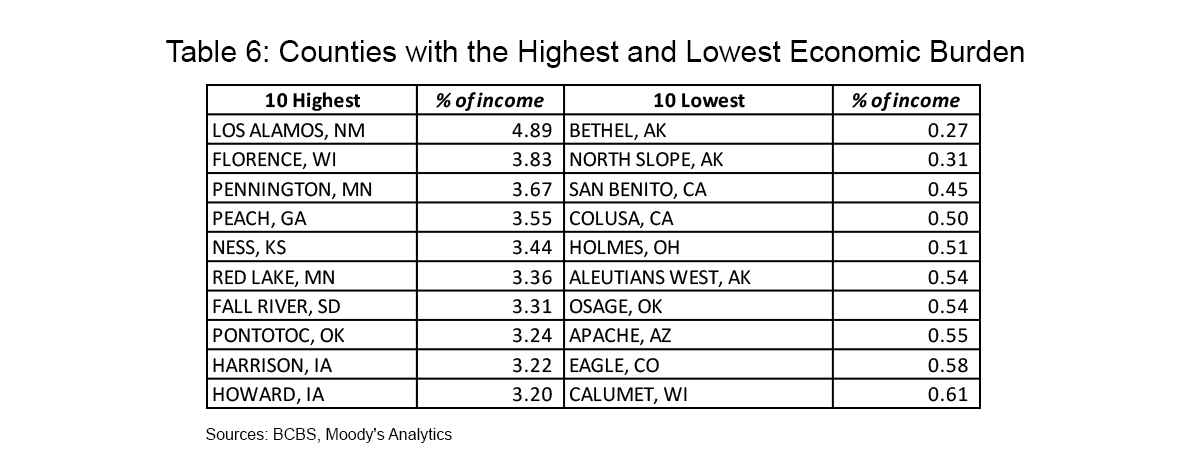

The economic impact of caregiving is far more disparate at the county level, ranging from negligible in some places to a more than 3% loss of total income in others (see Table 6). Counties at both ends of the spectrum tend to be smaller than average which naturally leads to higher levels of variability when estimating the impacts of caregiving. Those with the largest income impact not only face an elevated need for caregiving but also see increased rates of caregiving in the high demand category.

The focus of this analysis is to quantify the aggregate economic impact experienced by caregivers in the U.S. This was accomplished by looking at the employment, absenteeism, and productivity impacts of the direct time spent providing care as well as the toll that regularly providing uncompensated care can take on health outcomes. Previous studies have explored different approaches to estimating the impact of caregiving which can result in larger impact estimates than those included in this report. The primary difference lies in varying assumptions around the marginal value of uncompensated care.

Because our study aims to quantify the economic impact of caregiving it takes into account the fact that many caregivers providing help to family and friends are not giving up paid employment or other opportunities to do so. By this measure, our estimate of a $264 billion annual impact from caregiving should be viewed as a lower bound cost and not necessarily as a true value. If the billions of hours spent providing uncompensated care were converted to and valued at the same rate as professional care, the overall dollar amounts would be much larger. Additionally, while the indirect effect estimated in this report accounts for the impact of worsening caregiver health on aggregate economic outcomes—such as per capita income—it does not directly account for the fact that caregivers would also face higher healthcare expenditures as a result of their poorer health outcomes.

In 2017, AARP estimated that about 41 million family caregivers provided 34 billion hours of care with an estimated economic impact of $470 billion14. The $470 billion represents an estimate of the total cost of uncompensated care and was calculated assuming that the 41 million caregivers provided an average of 16 hours of care per week at an average of about $13.81 per hour. The value of an hour of care was calculated at the state level using the average of minimum wage, median home health aide wage and median private pay cost of hiring a home health aide. State-level estimates of caregiving intensity from the Behavioral Risk Factor Surveillance System were also considered, but it differed little from the national average so 16 hours per week was used across all states.

This type of analysis is not without fault. The primary issue being the assumption that all uncompensated care need be or could be converted to paid care. Many caregivers that are providing help to family and friends are not giving up paid employment or other opportunities to do so. As such, cost estimates based on this type of analysis are much larger than the economic impact of caregiving detailed in this report, which estimates the quantifiable impact of caregiving on employment, absenteeism, and caregiver health.

No matter how the impact and/or cost of caregiving is estimated, the result is that the impact is felt by a surprisingly large share of the population and it comes at an enormous cost. Based on our findings, these costs come in different forms such as lost jobs, increased absenteeism at work, and poorer health outcomes for those providing care which leads to a substantial economic cost.

The Blue Cross Blue Shield Association is an association of independent, locally operated Blue Cross and Blue Shield companies. Blue Cross and Blue Shield are registered trademarks of the Blue Cross Blue Shield Association.

© 2021 Moody's Corporation, Moody's Investors Service, Inc., Moody's Analytics, Inc. and/or their licensors and affiliates (collectively, "MOODY'S"). All rights reserved. CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. AND ITS RATINGS AFFILIATES ("MIS") ARE MOODY'S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND MOODY'S PUBLICATIONS MAY INCLUDE MOODY'S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES. MOODY'S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET IT'S CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODY'S OPINIONS INCLUDED IN MOODY'S PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY'S PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY'S ANALYTICS, INC. CREDIT RATINGS AND MOODY'S PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS AND MOODY'S PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT RATINGS NOR MOODY'S PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODY'S ISSUES ITS CREDIT RATINGS AND PUBLISHES MOODY'S PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE.

MOODY'S CREDIT RATINGS AND MOODY'S PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS AND INAPPROPRIATE FOR RETAIL INVESTORS TO USE MOODY'S CREDIT RATINGS OR MOODY'S PUBLICATIONS WHEN MAKING AN INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY'S PRIOR WRITTEN CONSENT.

All information contained herein is obtained by MOODY'S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided "AS IS" without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODY'S is not an auditor and cannot in every instance independently verify or validate information received in the rating process or in preparing the Moody's publications.

To the extent permitted by law, MOODY'S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any such information, even if MOODY'S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or damages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a particular credit rating assigned by MOODY'S.

To the extent permitted by law, MOODY'S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY'S or any of its directors, officers, employees, agents, representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY'S IN ANY FORM OR MANNER WHATSOEVER.

Source: https://www.bcbs.com/the-health-of-america/reports/the-economic-impact-of-caregiving

0 Response to "Is Blue Cross Blue Shield Indirect or Direct Distributiom"

Post a Comment